5 Key E-commerce Metrics to Track (and Improve)

Table of Contents

- Why E-commerce KPIs Matter

- Conversion Rate (CR)

- Average Order Value (AOV)

- Customer Lifetime Value (CLV)

- Customer Acquisition Cost (CAC) & Break-even ROAS

- Repeat Purchase Rate (RPR) & Retention

- FAQ

- Get Started with BrandSearch

Intro

Most e-commerce stores drown in data but starve for direction. You've got Google Analytics, Shopify reports, ad dashboards, email metrics—but which numbers actually move the needle? Analytics turns guesswork into growth, but only if you track the right e-commerce KPIs.

In this guide, we break down the five metrics that matter most—conversion rate, average order value, customer lifetime value, acquisition cost, and retention—with plain-English formulas, real benchmarks, and practical tactics you can test this week. Whether you're doing $10k or $10M in revenue, these fundamentals drive every successful e-commerce business.

Why E-commerce KPIs Matter

High-level dashboards look impressive in meetings, but decision-grade KPIs actually run your business. Well-chosen metrics do three things:

Align teams around growth goals. When marketing, product, and ops all optimize for the same north-star metric, you stop stepping on each other's toes.

Make trade-offs explicit. Running a 20% off sale lifts conversion rate and average order value in the short term—but what does it do to profit margins and customer lifetime value six months out? Good KPIs force you to think in systems, not silos.

Reveal where to allocate budget. Should you spend the next $10k on creative testing, retention email flows, or faster shipping? Your KPIs tell you which lever has the most headroom.

Pro tip: Pick one north-star revenue metric (like Revenue per Visitor or Monthly Recurring Revenue) and 3–5 driver KPIs that feed into it. Review these weekly in a living doc where you log hypotheses, tests, and outcomes. Monthly, zoom out to assess strategy and rebalance priorities.

Conversion Rate (CR)

What it is: The percentage of site visitors who complete a purchase. It's the most direct measure of how well your store turns traffic into revenue.

Formula:

CR = (Orders / Sessions) × 100%

Why it matters: A 1% conversion rate lift on 10,000 visitors means 100 more orders—with zero extra ad spend. Small CR gains compound fast because you're squeezing more value from traffic you've already paid to acquire.

Benchmark: Most Shopify stores convert between 1–3%. Top performers hit 4–6%, though this varies wildly by vertical (fashion and beauty skew lower, B2B and niche consumables can go higher). Mobile typically converts 30–50% lower than desktop, so segment your analysis by device.

How to improve conversion rate (fast)

1. Remove friction at every step

Page speed kills conversions. Compress images, lazy-load below-the-fold content, and eliminate layout shift (when elements jump around during load). Audit your checkout flow: every extra form field costs you orders. Enable express payment options like Shop Pay, Apple Pay, and Google Pay—one-click checkout can lift mobile CR by 20–30%.

Run a "fresh eyes" test: ask someone unfamiliar with your store to complete a purchase on mobile while you watch. You'll spot confusing nav, broken flows, and dead ends you've been blind to.

2. Match intent across the funnel

Your collection pages, search results, and product pages should mirror how real customers think and shop. If people search "running shoes for flat feet," don't just show them all running shoes—create a dedicated landing page that speaks to that specific problem.

Study your internal search terms in Shopify Analytics. The top 10–20 queries reveal exactly what customers want. Feature best-sellers prominently on collection pages; hide or fix products with high traffic but low conversion.

3. De-risk the buying decision

Unfamiliar brands need to prove trustworthiness fast. Add clear shipping and return policies above the fold. Surface reviews and UGC (user-generated content) near the "Add to Cart" button. Trust badges (secure checkout, money-back guarantee) reduce hesitation, especially for first-time buyers.

One overlooked tactic: show real-time social proof ("23 people are viewing this item" or "Sarah from Austin just bought this"). It creates urgency without feeling pushy.

4. Align ad creative with landing pages

If your Facebook ad promises "glass skin in 7 days," your product page headline better say the same thing—same language, same benefit. Mismatched messaging is one of the fastest ways to tank conversion. The ad gets the click; the landing page closes the sale. They need to feel like one continuous story.

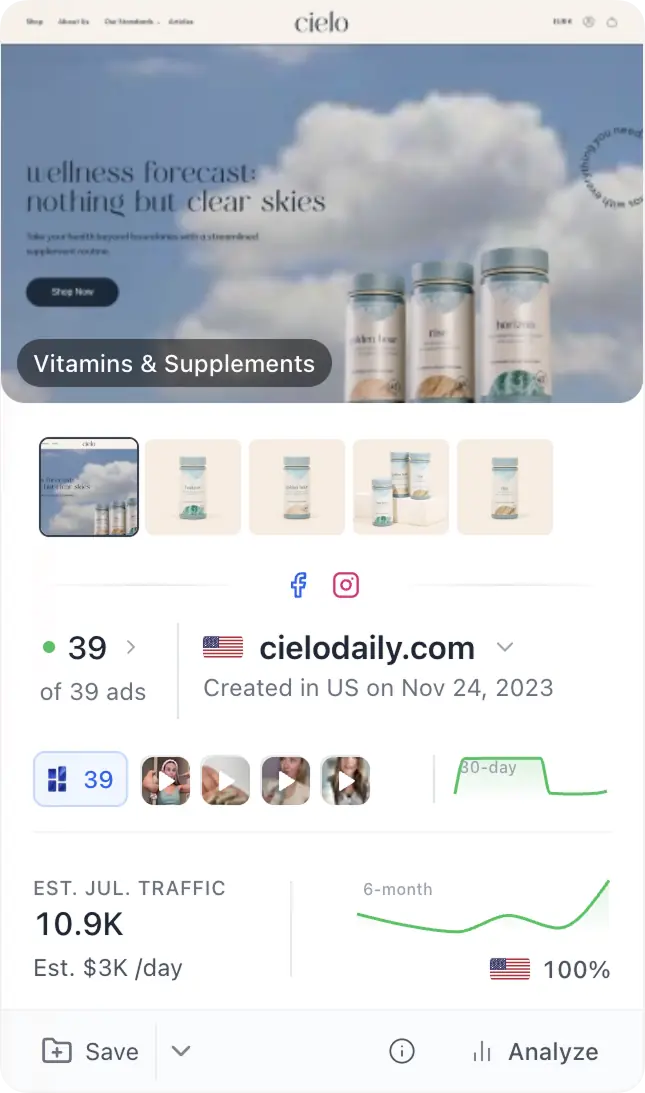

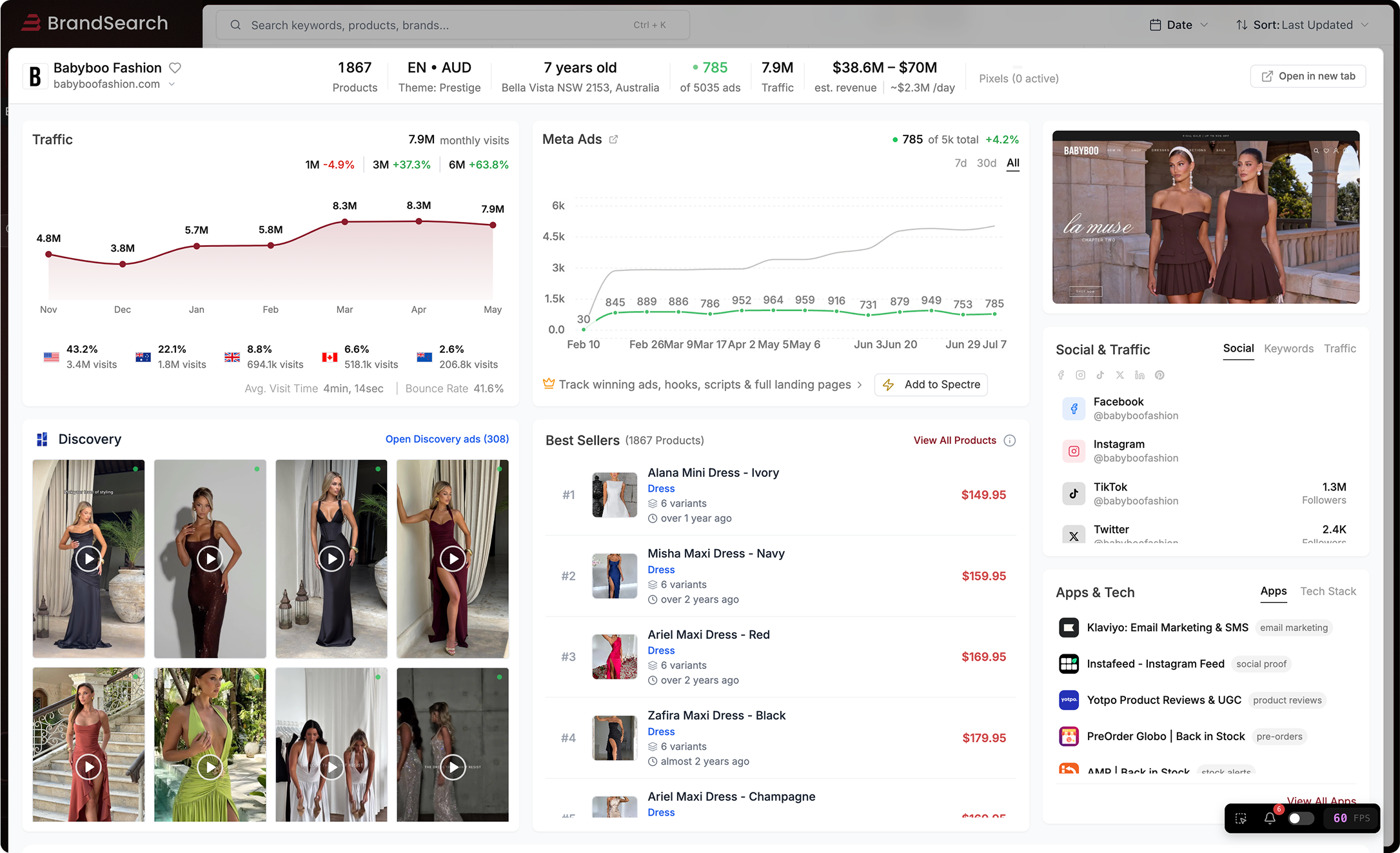

Spy on competitors' ads and landing pages to see what angles are working in your niche. The BrandSearch Chrome extension makes this process faster by letting you analyze ads and product pages as you browse, but even manual browsing through Facebook Ad Library can uncover winning patterns.

5. Fix losers before scaling winners

Sort your product pages by traffic volume, then filter for below-average conversion rate. These are your "leaky bucket" pages—they're getting eyeballs but bleeding revenue. Run small, controlled tests: rewrite the headline, add a comparison chart, swap the hero image. Fix one or two pages per week; the cumulative impact is massive.

Average Order Value (AOV)

What it is: The average dollar amount customers spend per transaction.

Formula:

AOV = Revenue / Orders

Why it matters: Raising AOV 10% often delivers more profit than a 10% traffic increase. You've already paid to acquire the customer—every additional dollar they spend has minimal marginal cost. It's one of the fastest levers to pull when you need to improve unit economics.

Benchmark: B2C average hovers around $50–$100, but this varies dramatically by category. Consumables (supplements, snacks, pet food) often sit in the $30–$60 range. Luxury goods, curated bundles, and anything subscription-based can push $150 or higher.

How to improve AOV (without tanking conversion rate)

1. Tiered free shipping thresholds

If your current AOV is $65, set free shipping at $80 or $85—about 15–25% above average. Customers will add one more item to hit the threshold rather than pay $7 for shipping. Make the threshold visible in the cart ("Add $15 more for free shipping!") with a progress bar.

Test different thresholds quarterly. If you set it too high, you'll increase cart abandonment. Too low, and you're giving away margin unnecessarily.

2. Smart product bundles

Bundle complements, not substitutes. If someone's buying a yoga mat, suggest a matching strap and block—not three different mats. Pre-select the most popular quantity or bundle size on your product page so the "add to cart" button defaults to the higher-value option.

Create "routine" or "starter" bundles that make sense for first-time buyers. Someone buying skincare doesn't know if they need the cleanser, toner, serum, and moisturizer—so build a "Complete Morning Routine" bundle at a 15% discount and make the decision easy.

3. In-cart cross-sells

Show 1–2 complementary add-ons directly in the cart. Keep these low-friction: small, inexpensive items that feel like obvious pairings ("Customers also added..."). Don't overwhelm the cart with eight options; that creates decision paralysis and increases abandonment.

The best cross-sells are consumables that need replenishment (batteries for electronics, filters for water bottles, accessories for the main product). These items also boost repeat purchase rate downstream.

4. Protect your pricing integrity

Frequent discounts train customers to wait for sales, which tanks AOV over time. Instead, keep your core prices stable and run value-based promotions: bundles, limited drops, or "buy 2, get 15% off" offers that reward higher spend without devaluing your brand.

If you do run discounts, make them time-limited and segment them (new customers only, VIP early access, or cart abandonment recovery). This preserves the perception of value for regular-price buyers.

5. Check your margins first

Before you chase AOV, make sure the math works. Run your proposed bundles and upsells through a profit margin calculator—factor in COGS, payment processing fees, shipping costs, and platform fees. A $20 AOV increase that costs you $18 in fulfillment isn't a win.

Customer Lifetime Value (CLV)

What it is: The total net revenue a customer generates over their entire relationship with your brand. Also called LTV (Lifetime Value), this metric captures the long game—not just the first order, but all the repeat purchases that follow.

Back-of-napkin formula:

CLV ≈ AOV × Purchase Frequency × Gross Margin × Avg Customer Lifespan (in orders or months) !

For a more accurate model, factor in discount rates, churn probability, and cohort-specific behavior. But the simple formula above gets you 80% of the way there for strategic planning.

Why it matters: High CLV lets you outbid competitors for ads and still stay profitable. If your CLV is $300 and you can afford a $100 CAC, you have $200 of headroom to acquire customers aggressively. Brands with low CLV live and die by the efficiency of their first transaction—one bad month of ad performance can sink them.

Benchmark: Aim for CLV ≥ 3× CAC to fund sustainable growth. Top-performing DTC brands hit 4–6× in mature customer cohorts. The longer you've been in business, the more valuable your older cohorts become—assuming you've built retention into your model.

How to improve customer lifetime value

1. Design retention into the product experience

The best retention starts before the customer even thinks about buying again. Build post-purchase email and SMS flows that teach customers how to use the product correctly. If they don't achieve a "first success moment" (the aha! when the product delivers on its promise), they'll never come back.

Include reorder reminders tied to typical usage cycles. If your protein powder lasts 30 days, send a replenishment email on day 25. If your skincare is a 60-day supply, remind them at day 50 with a one-click reorder link. Make it easier to buy again than to forget and churn.

2. Add subscriptions where they make sense

Don't force a subscription model if your product isn't a natural replenishment item. But if you sell consumables (coffee, supplements, pet food, razors), a well-executed subscription program can double CLV by locking in recurring revenue and reducing churn.

The key is flexibility: let customers pause, skip, or adjust delivery cadence without friction. Rigid subscriptions (hard to cancel, limited control) breed resentment and kill retention.

3. Build a launch rhythm

Seasonal launches, limited drops, and product line extensions re-activate dormant customers who loved their first purchase but haven't found a reason to come back. Create urgency by giving VIP customers early access—this builds community and rewards loyalty without training everyone to wait for discounts.

Track your launch calendar closely. Brands that release something new every 60–90 days see higher repeat rates than those that go silent for six months after a product launch.

4. Reduce friction to repurchase

Save payment and shipping info automatically (with permission). Offer one-click reorders from order confirmation emails or account dashboards. If someone bought the same product three times, pre-fill their cart when they land on the site.

The fewer steps between "I need more" and "Order placed," the higher your repurchase rate.

Customer Acquisition Cost (CAC) & Break-even ROAS

What it is: CAC is the average cost to acquire one new customer. ROAS (Return on Ad Spend) is the revenue generated per dollar spent on advertising. Both metrics measure efficiency, but from different angles.

Formulas:

CAC = Total Ad Spend / New Customers

Break-even ROAS ≈ 1 / Contribution Margin% (after COGS, shipping, payment fees, and variable costs)

Why it matters: If CAC exceeds CLV, you're buying customers at a loss—math that kills brands fast, even if revenue looks healthy on the surface. Break-even ROAS tells you the minimum return you need to stay cash-positive. Anything below break-even means you're burning money; anything above means you're profitable (assuming you've accounted for all costs).

Benchmark: Healthy DTC brands keep blended CAC between $20–$60 for products under $100, depending on margin and category. Target 2.5–4× ROAS as a baseline, though high-margin consumables can operate profitably at 2×, while low-margin goods need 5×+.

How to improve CAC and ROAS

1. Build a creative testing system

Winning ads decay fast—especially on Meta and TikTok, where audience fatigue sets in after 7–14 days. Run weekly creative sprints: test new hooks, formats, and angles. Don't just test variations of the same concept (red background vs. blue background). Test entirely different value props (problem-solution vs. transformation vs. social proof).

Study competitors' ads to identify saturated angles and whitespace opportunities. If everyone in your niche is running "before and after" testimonials, try an educational explainer or a founder story instead.

2. Match landing pages to ad creative

Your ad sets an expectation; your landing page must deliver on it immediately. If the ad promises "30% off first order," the landing page headline better say the same thing—in the same language, with the same imagery. Every mismatch is a leak in your funnel.

Run this test: show someone your ad, then show them your landing page five seconds later. If they can't instantly see the connection, you're losing conversions.

3. Diversify your channel mix

Relying 100% on paid Meta or Google ads makes you vulnerable to algorithm changes, CPM spikes, and iOS updates. Layer in cheaper acquisition channels: influencer partnerships, affiliate programs, SEO content, referral loops, and community building.

Blended CAC across multiple channels is almost always lower than single-channel CAC, because you're reaching different audience segments at different stages of awareness.

4. Run contribution-first math before scaling

Don't scale ads based on ROAS alone. Calculate your true contribution margin: revenue minus COGS, payment processing fees (2.9% + $0.30 per transaction on Shopify Payments), shipping costs, and any variable fulfillment costs. Your break-even ROAS is 1 / contribution margin %.

If your contribution margin is 40%, your break-even ROAS is 2.5×. Anything below that is unprofitable, even if it looks good in your ad dashboard. Use a breakeven ROAS calculator or a simple spreadsheet to validate every promotion before you scale it.

5. Stress-test your cash runway

High-growth e-commerce brands often go broke while scaling profitably—because ad spend hits your account 30 days before revenue lands in the bank. Model your cash flow scenarios: if you 3× ad spend next month, can you cover payroll, inventory, and platform fees while waiting for revenue to catch up?

Run "what if" scenarios in a cashflow calculator or spreadsheet. Factor in payment processor holds, Shopify's payout schedule, and inventory lead times.

Need a quick reality check before scaling?

Compare your pricing, bundles, and creatives to live competitors—then sanity-check your break-even ROAS.

Start with BrandSearch Discovery →

Repeat Purchase Rate (RPR) & Retention

What it is: The percentage of customers who come back and make a second (or third, or tenth) purchase. Retention is the silent profit multiplier in e-commerce.

Formula:

RPR = Customers with ≥2 Orders / Total Customers

Why it matters: Repeat customers cost 5–7× less to acquire than new ones and spend 2–3× more per transaction. Retention lifts CLV, cuts blended CAC, and stabilizes cashflow. If you can't get customers to buy twice, your business is a leaky bucket—you're constantly refilling the top while revenue drains out the bottom.

Benchmark: Strong DTC brands see 25–40% RPR within six months of a customer's first purchase. Consumables and subscription businesses can hit 50–70% because the product naturally requires replenishment.

How to improve repeat purchase rate

1. Onboard customers into a habit

The window between first purchase and second purchase is make-or-break. Send a post-purchase email series that teaches customers how to use the product, shares tips from your community, and celebrates small wins. The goal is to create a "first success moment" as fast as possible.

If your product is coffee, teach them how to dial in the perfect brew. If it's skincare, explain the routine and when to expect results. If they don't experience the benefit, they'll never buy again—no matter how good your product is.

2. Build lifecycle nudges around real behavior

Map your customers' natural replenishment cycles. How long does your product typically last? For consumables, send a reorder reminder right before they run out—not two weeks after. For non-consumables (clothing, home goods), identify behavioral triggers: seasonal changes, life events, or new product launches that give them a reason to come back.

Winback campaigns at 45–90 days can recapture customers who loved their first order but lost momentum. Offer a product-led incentive (not just a discount): a new SKU, a bundle, or a limited drop.

3. Create community and trust

Brands with strong communities see higher retention. Feature customer reviews, UGC, and testimonials prominently on your site. Highlight customer stories that show the product in real life, not just studio shots.

Build a branded hashtag, encourage customers to share their experience, and re-share the best content. This creates social proof for new buyers and reinforces identity for existing customers ("I'm part of this community").

4. Merchandise for returning customers

First-time buyers and repeat customers have different needs. Use email segmentation and on-site personalization to show returners new products, bundles, or limited drops they haven't seen. Give VIPs early access to launches and exclusive offers that make them feel valued.

Build a simple loyalty program—even just points for purchases—if you have the margin to support it. The psychological effect of "earning progress" keeps customers engaged between purchases.

FAQ

What's a good conversion rate for Shopify stores?

Most Shopify stores convert between 1–3%; top performers hit 4–6%. But "good" depends on your vertical, traffic source, and price point. Rather than chasing industry averages, segment by channel (paid search, social, email, organic) and improve week over week. A store converting 2.5% from paid ads but 8% from email isn't broken—it's normal. Focus on closing the gap by improving ad-to-landing-page consistency and site experience.

How do I calculate customer lifetime value (CLV)?

Start simple: CLV ≈ AOV × Purchase Frequency × Gross Margin × Avg Customer Lifespan. If your average order is $75, customers buy 3 times per year, your gross margin is 60%, and they stay active for 2 years, your CLV is roughly $270. For more precision, analyze cohorts by acquisition channel and factor in churn rates over time. Use the LTV calculator for quick scenario planning, or build a custom model in your analytics platform.

Should I raise AOV even if conversion rate drops?

Sometimes, yes—if the net effect on revenue and profit is positive. Run the math: if AOV increases 15% but CR drops 5%, you're still ahead. The key is watching contribution margin, not just top-line revenue. A $10 AOV increase that comes from low-margin upsells might hurt profitability. Validate any pricing or bundle changes in a profit calculator before you roll them out site-wide.

What's the difference between CAC and ROAS?

CAC is cost per customer; ROAS is revenue per ad dollar. CAC focuses on acquisition efficiency (lower is better). ROAS focuses on return (higher is better). You need both metrics. High ROAS with thin margins can still lose money. Low CAC with poor retention is unsustainable. The healthiest businesses optimize for CAC < 1/3 of CLV and ROAS above their break-even threshold.

How often should I review e-commerce KPIs?

Weekly for tactical decisions (creative performance, promo results, site changes). Monthly for strategic shifts (budget reallocation, new channels, pricing). Keep a living doc where you log hypotheses, tests, and outcomes. This becomes your institutional knowledge—so when something works (or tanks), you know why. Use competitor intelligence tools to track changes in your niche and spot opportunities before they're obvious.

Where do I start if everything looks broken?

Start at the top of the funnel: fix your break-even ROAS math first. If you're losing money on every customer, nothing else matters. Then, improve conversion rate on your highest-traffic pages (you'll see results fastest here). Next, lift AOV through bundles and incentives. Finally, scale retention to grow CLV. This sequence maximizes short-term cash flow while building long-term value.

Get Started with BrandSearch

The brands winning in e-commerce today aren't guessing—they're learning from the market in real time. BrandSearch helps you analyze over 5 million Shopify stores, track competitor strategies, and validate product ideas before you invest.

Use Discovery to spot trending products and positioning angles. Explore the Brand Library to study high-performers in your niche. Track competitors' site changes, product launches, and creative pivots. Or install the free Chrome Extension to spy on ads and landing pages as you browse.

Whether you're optimizing existing metrics or searching for your next winning product, start with the data that's already working for someone else.