Top 100 Trending eCommerce Niches — November 2025

Ranked by average monthly traffic per brand

📊 Overview

A founder discovered "Milk Coolers" on last month's list — 13 brands, 676K avg traffic. Their Q4 launch just crossed $31K in revenue.

57 niches in this report have fewer than 20 active brands while averaging over 100K monthly visits each. These aren't hypothetical opportunities — they're live market gaps where smart operators are already building.

Our monthly analysis of 150 product categories surfaces the highest-potential eCommerce niches for November 2025. Every keyword is backed by real traffic data from active DTC brands.

Why this matters: High traffic per brand = validated demand + low saturation. The formula for profitability before markets mature.

🏆 Top 10 Niches — November 2025

1. Milk Coolers

Avg Traffic/Brand: 676.3 K | Active Brands: 13

TikTok's "coffee station aesthetic" trend meets functionality. High visual appeal drives UGC potential, and the low brand count signals room to establish market position before saturation.

Brand Example: Momfann — 6-month-old brand from Albany, NY pulling 3.4K monthly visits with +921% month-over-month growth. Running 65 active Meta ads with strong EU traction (18K monthly, €136/day adspend).

2. Workout Tights

Avg Traffic/Brand: 624.8 K | Active Brands: 29

Athleisure demand shows no signs of slowing. Fabric innovation (squat-proof, compression tech) creates differentiation angles, and before/after content performs exceptionally well on Meta ads.

Brand Example: Alo Yoga — LA-based powerhouse (8 years) generating 18M monthly visits and $87-159M estimated revenue. 576 active ads, 602K TikTok followers, and +85% month-over-month traffic growth proves the category's staying power.

3. Egift Cards

Avg Traffic/Brand: 507.0 K | Active Brands: 55

Last-minute gifting behavior + B2B corporate reward programs create dual revenue streams. Experience-based offerings outperform generic retail cards on perceived value.

Brand Example: Dry Bar Comedy — Provo-based comedy brand (4 years) with 8K monthly visits and 127 active ads showing +20.7% weekly ad growth. Bestseller: $50 E-Gift Card at $43.66 — proving experience-based gifting converts.

4. Gaming Smartphones

Avg Traffic/Brand: 400.7 K | Active Brands: 13

Mobile gaming continues its explosive growth. High AOV category with strong Q4 gifting potential and passionate community that responds well to spec-focused content.

Brand Example: RedMagic — Hong Kong gaming phone specialist (7 years) with 1.8M monthly visits and +123% month-over-month growth. 123 active ads, 763K TikTok followers. Flagship REDMAGIC 10 Pro sells at $599 — high AOV validated.

5. Baby Bottle Sterilizers

Avg Traffic/Brand: 359.5 K | Active Brands: 26

High-intent parent purchases with strong registry presence. UV sterilization tech creates premium positioning, and safety-focused messaging resonates across all marketing channels.

Brand Example: Baby Brezza — Australian arm of the baby tech brand (4 years) pulling 17K monthly visits with +87.7% 3-month growth. 13 active ads, all products live. Bestseller: Bottle Washer Pro tablets at $49.95 — consumables drive retention.

6. Blunt Cut Wigs

Avg Traffic/Brand: 305.8 K | Active Brands: 11

Protective styling trend with low competition. YouTube tutorials and TikTok transformations generate organic demand; high search intent converts well on Google Shopping.

Brand Example: Luvme Hair — Singapore-based wig brand (7 years) dominating with 3.4M monthly visits and $16-29M revenue. 658 active ads, 539K TikTok, 292K YouTube. +47.9% monthly growth shows category momentum.

7. Animal Rescue Merchandise

Avg Traffic/Brand: 285.4 K | Active Brands: 41

Mission-driven commerce with exceptional community engagement. Cause marketing creates organic sharing, and emotional storytelling outperforms traditional product ads.

Brand Example: The Animal Rescue Site — Seattle-based cause commerce giant (5 years) with 11.7M monthly visits and $56-103M revenue. 2,000 products, 48 active ads. Bestseller: "Needed Most Fund" at $1 — micro-donations drive massive engagement.

8. Comfort Mats

Avg Traffic/Brand: 279.6 K | Active Brands: 18

Standing desk adoption fuels consistent demand. B2B crossover potential (office outfitting) adds revenue stream, and "standing desk foot pain" keywords convert at high rates.

Brand Example: Muscle Mat — Australian comfort brand (5 years) with 131K monthly visits, +89.9% monthly growth, and 724 active ads. 4.7★ rating (425 reviews). Bestseller: Luxury Mattress Topper at $129 — premium positioning works.

9. Vacuum Bottles

Avg Traffic/Brand: 279.4 K | Active Brands: 33

Sustainability meets everyday utility. Eco-conscious positioning resonates with millennials, and customization options (corporate gifting, personal branding) expand market reach.

Brand Example: Stanley 1913 — Seattle heritage brand (5 years DTC) crushing it with 7.4M monthly visits and $36-65M revenue. 1.6M TikTok followers, 84 active ads. The Quencher H2.0 Tumbler at $45 became a cultural phenomenon.

10. Floodlight Cameras

Avg Traffic/Brand: 274.1 K | Active Brands: 13

Package theft anxiety drives consistent demand. Smart home integration and comparison content (vs Ring/Nest) generate strong organic traffic with high purchase intent.

Brand Example: Arlo — Milpitas-based smart security brand (4 months DTC) already at 453K monthly visits with +57% growth. 21 active ads, 76K TikTok, 57K YouTube. Video Doorbell bestseller at $49.99 — accessible entry point drives adoption.

💡 Key Insights — November 2025

- 57 low-saturation opportunities: Niches with fewer than 20 brands maintaining 100K+ traffic — ideal timing before Q4 competition heats up.

- Gaming tech momentum: 3 gaming-related niches in the top 20 signal sustained consumer investment in mobile/portable gaming.

- Parenting products surge: Baby-focused categories show strong traffic-per-brand ratios with high purchase intent.

- Purpose-driven commerce works: Cause-based niches like Animal Rescue Merchandise prove mission-aligned brands capture attention and loyalty.

- 21 high-efficiency niches: Categories showing >150K traffic with <25 brands — the sweet spot for new market entrants.

- Sustainability as baseline: Eco-conscious categories continue climbing; green positioning is now expected, not exceptional.

📈 Complete Top 100 Rankings — November 2025

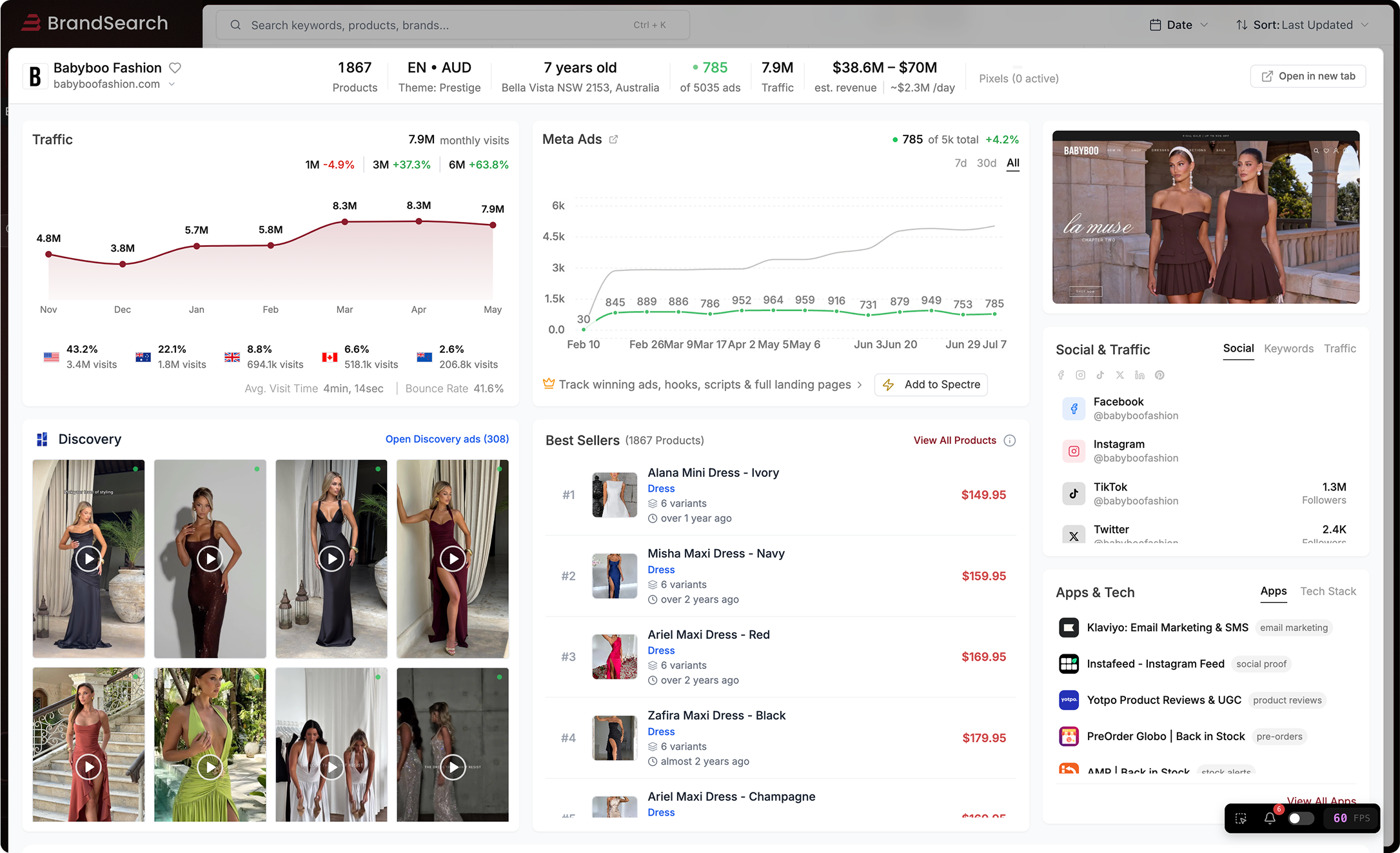

Data source: BrandSearch, November 2025

🔬 Methodology

This dataset is powered by BrandSearch's proprietary eCommerce intelligence platform, tracking:

- Real-time traffic data from thousands of Shopify and DTC brands

- Brand saturation metrics — active competitors per niche

- Ad spend signals — active/total ads as demand proxy

- Traffic efficiency ratio — avg monthly visits per brand (the key profitability indicator)

Why "Avg Traffic per Brand" beats total traffic:

- 10M total traffic ÷ 500 brands = 20K per brand (saturated)

- 2M total traffic ÷ 10 brands = 200K per brand (opportunity)

We rank by efficiency, not volume.

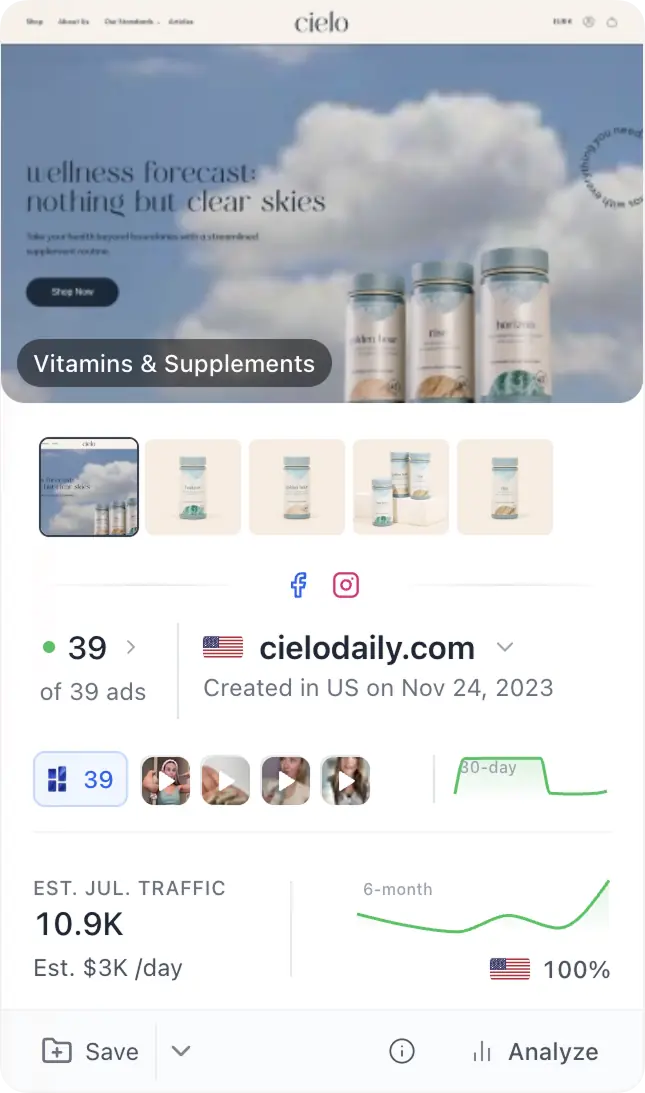

🚀 About BrandSearch

BrandSearch is the market research platform for eCommerce founders, growth marketers, and investors who need to:

✅ Spot emerging niches before saturation hits

✅ Validate product ideas with real brand data (not just search trends)

✅ Track competitors — ads, traffic, strategies

✅ Find white-space opportunities — low competition + high demand

Used by 10,000+ eCommerce professionals for smarter, data-driven decisions.

👉 Get started with BrandSearch →

Dataset generated December 2025 • Analysis period: November 2025 • BrandSearch Intelligence