10 Monoproduct Brands Worth Watching (November 2025)

One product. Zero distractions. Millions in revenue.

👉 See monoproduct brands scaling right now on BrandSearch →

📊 Overview

Vivanmn sells one thing: NMN capsules. They're doing $31K/day.

While most eCommerce entrepreneurs spread themselves thin across dozens of SKUs, a growing number of founders are betting everything on a single product. And winning. These monoproduct brands prove that focus, not variety, drives scalable growth.

This month, we picked 10 single-product stores and sorted them by traffic. What we found: lean operations, aggressive ad strategies, and products that solve one problem exceptionally well.

What Is a Monoproduct Brand?

A monoproduct brand is exactly what it sounds like: one company, one product. No catalog to manage. No inventory headaches across multiple SKUs. Just a single hero product that carries the entire business.

Think Crocs before they expanded. Spanx in the early days. The Snuggie. These brands built empires on one brilliant idea before diversifying.

The modern version? DTC stores laser-focused on solving a specific problem — a nail cutter that actually cuts clean, a supplement that targets one health concern, a bag designed for one use case.

Why Monoproduct Works in 2025

The monoproduct model isn't just simpler — it's strategically superior for early-stage brands:

Messaging clarity: When you sell one thing, your value proposition is crystal clear. Ads convert better. Landing pages perform. There's no confusion about what you offer.

Operational simplicity: One SKU means streamlined inventory, simpler fulfillment, and fewer supplier headaches. Your entire team focuses on making one product exceptional.

Ad efficiency: Meta and Google algorithms love consistency. Running all your spend behind one product means faster learning, better optimization, and higher ROAS.

Brand identity: Customers remember "the company that makes X" far better than "the company that makes X, Y, and Z." Specialization builds authority.

Lower risk to validate: Testing one product costs less than launching a full catalog. You can iterate faster and pivot without sunk costs across multiple SKUs.

How to Launch a Monoproduct Brand

Before diving into the rankings, here's the playbook successful monoproduct founders follow:

1. Find a problem worth solving

The best monoproduct brands don't sell commodities — they fix specific frustrations. EDJY didn't create "another nail clipper." They reinvented how nails get cut. Look for products where the existing solutions are "good enough" but not great.

2. Validate before you build

Use tools like BrandSearch to see if similar products have traction. Check competitor ad libraries. Run a simple landing page test before committing to inventory.

3. Build a brand, not just a product

Monoproduct doesn't mean mono-brand. Create a story, a mission, an identity that transcends the SKU. Vivanmn isn't selling capsules — they're selling longevity. Tap Out isn't selling NFC chips — they're selling focus.

4. Go deep on one channel first

Don't spread your marketing budget across five platforms. Master Meta ads, or dominate TikTok organic, or own your SEO niche. Then expand.

5. Know when to evolve

The best monoproduct brands eventually expand — but only after establishing dominance. EDJY is already teasing a toenail cutter for 2025. Timing matters.

🏆 10 Monoproduct Brands — November 2025

Ranked by monthly traffic

1. Vivanmn — NMN Longevity Supplement

Monthly Traffic: 138.4K | Est. Revenue: $674K–$1.2M/month | Active Ads: 120

The UK-based longevity brand has built an empire on a single molecule: NMN (Nicotinamide Mononucleotide). Their Pure NMN capsules promise better energy, improved sleep, and cellular health support. And the market is buying it.

What makes Vivanmn work: they've positioned themselves as the premium, UK-made alternative in a sea of questionable supplements. Third-party testing, clean branding, and a subscription model drive 84% repeat purchases. They've been featured in Women's Health and built serious TikTok traction with biohacking content.

At £29.99 per bottle with €384K total EU adspend, they're proof that wellness supplements still print money when done right.

2. EDJY — Single-Blade Nail Cutter

Monthly Traffic: 128.2K | Est. Revenue: $624K–$1.1M/month | Active Ads: 141

Here's a sentence you probably never expected to read: someone built a million-dollar brand selling nail cutters at $16.50 each.

EDJY reimagined a product that hasn't meaningfully evolved since 1881. Their single-blade design cleanly cuts (instead of crushing) nails, collects clippings, and lasts a lifetime. Made in Michigan, developed with a dermatologist, and tested over 150,000 cycles.

The genius? They turned a $2 commodity into a $16.50 premium product by focusing on a real problem nobody else bothered to solve. TikTok demos showing the difference between EDJY's clean cuts vs. traditional clippers' crushed edges do the selling.

3. Luum — Gut Health Supplement

Monthly Traffic: 114.3K | Est. Revenue: $557K–$1M/month | Active Ads: 60

Founded in 2025, Luum entered the crowded supplement space with a differentiated angle: a three-phase gut restoration system called Corewell™. Rather than another generic probiotic, they've built a Cleanse → Repair → Rebalance protocol with 16 clinically studied ingredients.

The founder story resonates: Mohammad Bazeed struggled with digestive issues for 15 years before creating the solution he couldn't find. That authenticity drives their messaging.

At $79 per bottle with a 90-day money-back guarantee, Luum is scaling fast — +913% month-over-month traffic growth signals they've found product-market fit.

4. Faith Linen — European Linen Sheets

Monthly Traffic: 63.2K | Est. Revenue: $308K–$559K/month | Active Ads: 273

Faith Linen sells one thing: linen bedding sets at $99.95. Their pitch? "European flax linen" that regulates temperature, gets softer with every wash, and helps you sleep better.

The brand is riding the natural bedding wave hard, with 273 active ads pushing sleep-focused messaging. They're targeting the growing segment of consumers willing to pay more for natural materials over synthetic alternatives.

With +230% monthly traffic growth and UK presence (387K reach, €4.4K total EU adspend), Faith Linen shows that even "boring" product categories can build momentum with the right positioning.

5. Olivia Blaire — Iron Wand Mascara

Monthly Traffic: 62.4K | Est. Revenue: $304K–$551K/month | Active Ads: 146

Olivia Blaire went viral with a simple innovation: replace traditional mascara bristles with a grooved metal wand. The result? Precise application, better curl hold, and zero clumping.

Their Iron Wand Mascara at $21.75 has accumulated 388 Trustpilot reviews, with customers raving about all-day curl retention — especially those with notoriously straight Asian lashes who've struggled with every other mascara.

The brand leans heavily into UGC and before/after content. Manufactured by COSMAX (a top-tier cosmetics company), they've got the credibility to back up the innovation claims. With €85K total EU adspend, they're betting big on Meta.

6. Tap Out — Phone Addiction Blocker

Monthly Traffic: 44.1K | Est. Revenue: $214K–$389K/month | Active Ads: 56

This Amsterdam-based startup sells a physical NFC chip (€44.95) that acts as a "key" to lock and unlock your phone apps. Want to access Instagram? You have to physically tap the Tap Out point — which you've strategically placed in another room.

It's brilliantly simple: unlike software blockers that can be bypassed with a quick "ignore," Tap Out creates a real physical barrier. Users report 60% screentime reductions.

The product was prototyped in a week using AI and a 3D printer by founders Xan and Tobi. Now it's doing ~$10K/day with strong word-of-mouth among productivity communities and ADHD audiences. With €16.3K total EU adspend and a "no subscription, buy once" model, they're building trust fast.

7. Primal Viking — Testosterone Support

Monthly Traffic: 40.1K | Est. Revenue: $195K–$354K/month | Active Ads: 251

Primal Viking sells a single testosterone support supplement ($89) built around an "ancestral" thesis: modern men are nutrient-deficient because we stopped eating like our ancestors. Their solution? Freeze-dried reindeer organs (liver, heart, kidney, testicles) plus Arctic herbs.

The branding is aggressive — targeting men concerned about declining testosterone with Viking-themed masculinity messaging. It's polarizing by design.

With +10,152% three-month traffic growth, 251 active ads, and €21.4K total EU adspend across 27 countries, they've clearly found an audience. The founder's transformation story (with before/after photos) drives the marketing.

8. Levence — Anti-Theft Shoulder Bag

Monthly Traffic: 31.3K | Est. Revenue: $152K–$276K/month | Active Ads: 88

Levence sells one product: a premium leather underarm shoulder bag ($52.95) designed with hidden anti-theft compartments. Think of it as a modern, stylish money belt for travelers who don't want to look like tourists.

The positioning is smart — they're not competing with backpack brands or traditional messenger bags. They own a specific niche: secure, discreet carry for urban travel.

With +1,243% monthly traffic growth and €29.2K total EU adspend across 34 countries, Levence is scaling fast on a product that solves a real anxiety for international travelers.

9. Pawspaco (Vitacore) — Portable Electric Heater

Monthly Traffic: 25.3K | Est. Revenue: $123K–$223K/month | Active Ads: 57

Pawspaco (operating under the Vitacore brand) sells a single portable electric heater at $69.99. The product heats up in 2-3 seconds, features auto shut-off, and ships from a US warehouse.

Classic dropshipping-style execution, but with solid fundamentals: +174% monthly growth, 57 active ads all running the same product, and strong conversion messaging around instant warmth for garages, greenhouses, and home offices.

The timing is perfect — Q4 cold weather drives seasonal demand, and they're positioned to capture it.

10. Lumoria — Posture Corrector Vest

Monthly Traffic: 2.1K | Est. Revenue: $10K–$18K/month | Active Ads: 235

The newest entrant on our list, Lumoria sells a posture correction vest at €70. It's a French-market focused brand (100% France traffic) that just started scaling in November — from zero to 2.1K monthly visits with 235 active ads.

Despite lower traffic, they're spending €12.7K total on EU ads, signaling confidence in their unit economics. The product targets a massive pain point: back pain from desk work and phone usage.

Early stage, but worth watching as they optimize their funnel.

Key Takeaways

Focus wins: Every brand on this list proves that you don't need 50 SKUs to build a real business. One product, executed exceptionally well, can generate millions.

Solve real problems: EDJY fixed nail cutting. Tap Out fixed phone addiction. Levence fixed travel anxiety. The best monoproduct brands don't sell commodities, they solve specific frustrations.

Brand > Product: Vivanmn isn't "the NMN company", they're a longevity brand. Primal Viking isn't "supplements", they're ancestral wellness. Build identity beyond the SKU.

Timing matters: Portable heaters in Q4. Gut health supplements during wellness season. Smart founders align launches with demand cycles.

Ads fuel growth: Every brand here runs significant paid media. Monoproduct businesses can afford to go deep on ads because there's no creative complexity — just iterate on one hero product.

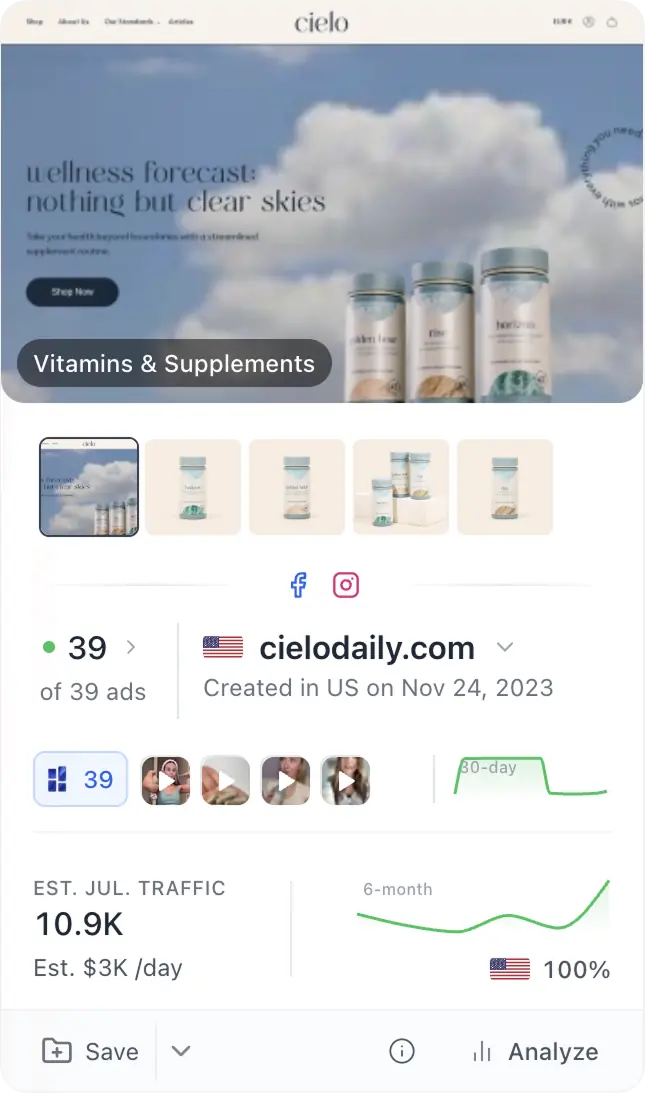

🌱 Bonus: Rising Stars to Watch

These three brands haven't proven themselves yet, they're either pre-revenue or just starting to generate sales. But they show interesting signals worth monitoring. Here's our honest take on each.

Kerarose — Rosemary Hair Growth Shampoo

Monthly Traffic: 4.1K | Est. Revenue: $20K–$37K/month | Active Ads: 456

The story: A Miami-based brand (1 month old) selling a single rosemary + keratin shampoo at $35.95. The pitch: stronger hair, less breakage, faster growth — without the complexity of multi-step routines.

What's interesting: 456 active ads is aggressive for a brand this young. They're clearly testing hard and fast, running ads across 4 Facebook pages with multiple creative variants. The product is also listed on Amazon (under "Tgideas" — likely their supplier or white-label source), which suggests they're not manufacturing but rather branding an existing formula.

Our honest take: The rosemary hair growth market is absolutely massive right now — TikTok has driven huge demand for rosemary oil products. But here's the problem: the market is also incredibly saturated. A quick Amazon search shows dozens of nearly identical products at lower prices. Kerarose's challenge will be differentiation. Right now, they're running a volume play: blast ads, acquire customers, hope the unit economics work. With ~$945/day in revenue and €176 total EU adspend, the numbers suggest they're primarily US-focused and potentially profitable — but sustainability depends on repeat purchases in a category where brand loyalty is notoriously low. Verdict: High risk, high reward. Watch their retention, not just acquisition.

NL StrideSafe — Anti-Theft Crossbody Bag

Monthly Traffic: 0 | Est. Revenue: N/A | Active Ads: 246

The story: A Sweden-based brand (1 month old) selling an anti-theft crossbody bag at €34.99. The product targets travelers worried about pickpockets — featuring hidden compartments, slash-resistant straps, and RFID blocking.

What's interesting: 246 active ads with zero measurable traffic on BrandSearch. But don't read too much into this — the brand is only 1 month old, and traffic data often lags for new stores. They've spent €31.9K total on EU/UK ads reaching 4.2M people, which suggests real ad activity. The question is whether those clicks are converting.

Our honest take: The anti-theft bag market is proven — Pacsafe, Travelon, and Baggallini have built real businesses here. StrideSafe's challenge is the competitive landscape: established players have years of reviews, trust signals, and retail distribution. A new entrant needs either a genuine product innovation or exceptional branding to compete.

The "0 traffic" on BrandSearch is normal here. Traffic data shows the previous month, so a 1-month-old brand simply hasn't had time to generate visible stats yet. The €31.9K adspend with 4.2M reach confirms they're actively driving traffic. We'll have real numbers next month.

Verdict: Market is validated, execution TBD. The product looks similar to existing options, so differentiation will be key. Check back in 60 days when we have real traffic data.

ELMS — LiftPatch (Breast Enhancement Patch)

Monthly Traffic: 0 | Est. Revenue: N/A | Active Ads: 45

The story: A New Zealand-based brand (2 months old) selling a "LiftPatch", a wearable patch claiming to support breast lift and fullness through "transdermal botanical delivery." Price: $26.95 (on sale from $49.99).

What's interesting: This is targeting a massive insecurity market with a non-surgical, non-hormonal positioning. The messaging is clever: "Fuller cups, just without the hassle." They're specifically calling out women frustrated with creams, pills, and pumps. With only €61 total EU adspend but 45 active ads, they're primarily testing outside Europe.

Our honest take: Let's be direct. This product category has a troubled history. "Breast enhancement" patches, pills, and creams have been the subject of countless FTC complaints and consumer protection lawsuits. The science behind "transdermal botanical delivery" for breast enhancement is, to put it politely, unproven. That doesn't mean ELMS won't make money (plenty of brands in this space do), but the risk profile is different: potential platform bans, payment processor issues, and regulatory scrutiny. The site itself is well-designed with fake "Facebook testimonials" (a red flag), aggressive discounting, and urgency tactics. This looks like a classic dropship play optimized for impulse purchases, not repeat customers. Verdict: High short-term potential, high long-term risk. Not a brand we'd invest in building.

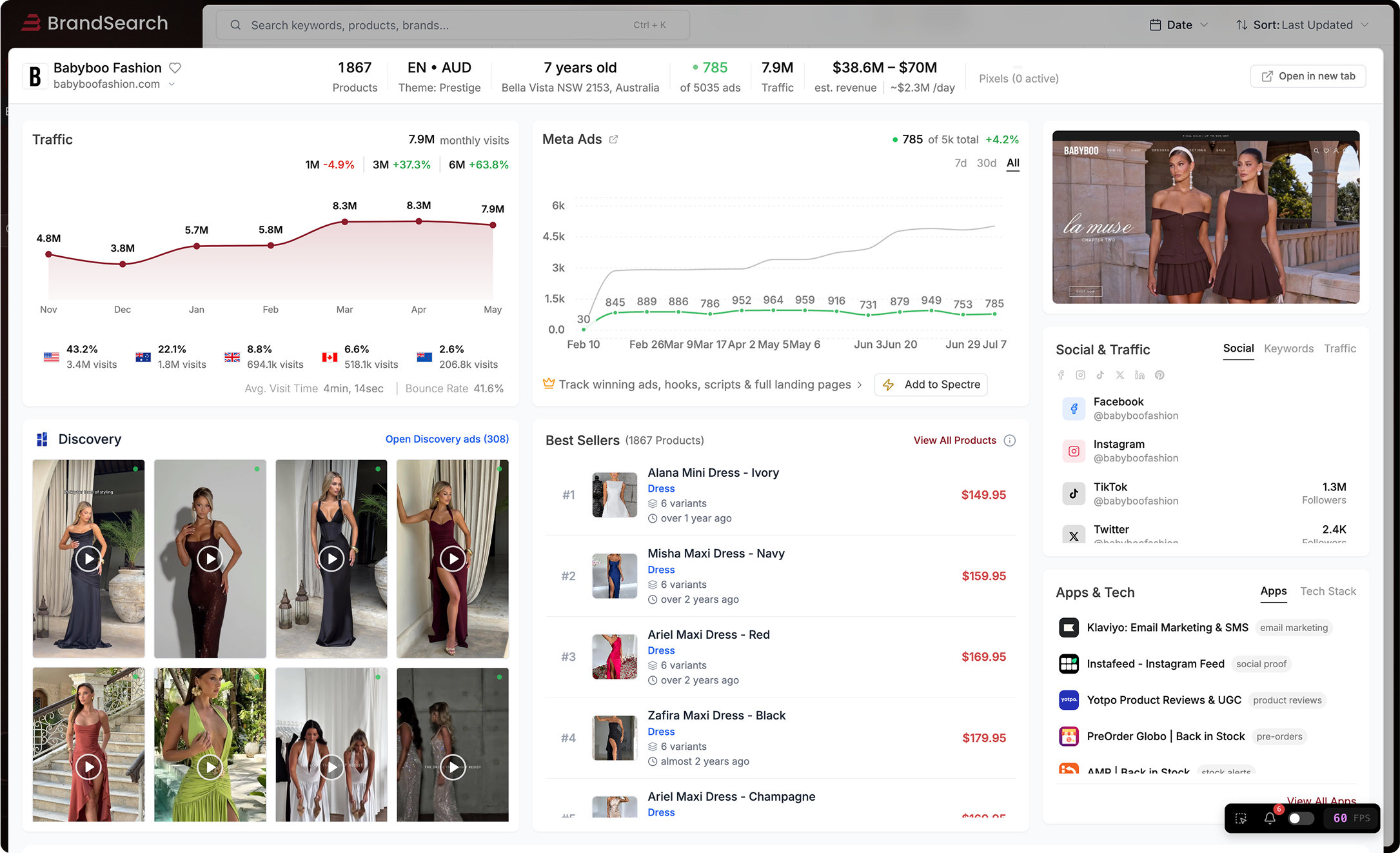

🔬 Methodology

This ranking is powered by BrandSearch's eCommerce intelligence platform, tracking:

- Real-time traffic data from Shopify and DTC brands

- Active ad counts across Meta, TikTok, and Google

- Revenue estimates based on traffic, conversion benchmarks, and AOV

- Growth signals including month-over-month traffic changes

Brands were filtered for single-product focus (1-3 SKUs maximum, all variations of the same core product) and ranked by November 2025 monthly traffic.

🚀 About BrandSearch

BrandSearch helps eCommerce founders, marketers, and investors discover what's actually working in DTC.

✅ Find winning products before they're saturated

✅ Analyze competitor strategies: ads, traffic, tech stacks

✅ Track emerging brands in real-time

✅ Validate ideas with real market data

Used by 10,000+ eCommerce professionals for smarter, data-driven decisions.

👉 See monoproduct brands scaling right now →

Data collected December 2025 • Analysis period: November 2025 • BrandSearch Intelligence